deferred sales trust problems

If you own a highly appreciated asset that you wish to sell one of your main concerns likely is the. GET YOUR FREE GUIDE AND STRATEGIC CONSULTATION CALLClick this link now.

Deferred Sales Trust Defer Capital Gains Tax

If the trust is improperly managed.

. We are experts and focuse. Know your options and know the deal in your termsCapital Gains Tax Solutions is an exclusive trustee for the deferred sales trust. In September 2019 the California Franchise Tax Board FTB issued a notice to 1031 Exchange Qualified Intermediates QIs that the state will begin imposing penalties against QIs who.

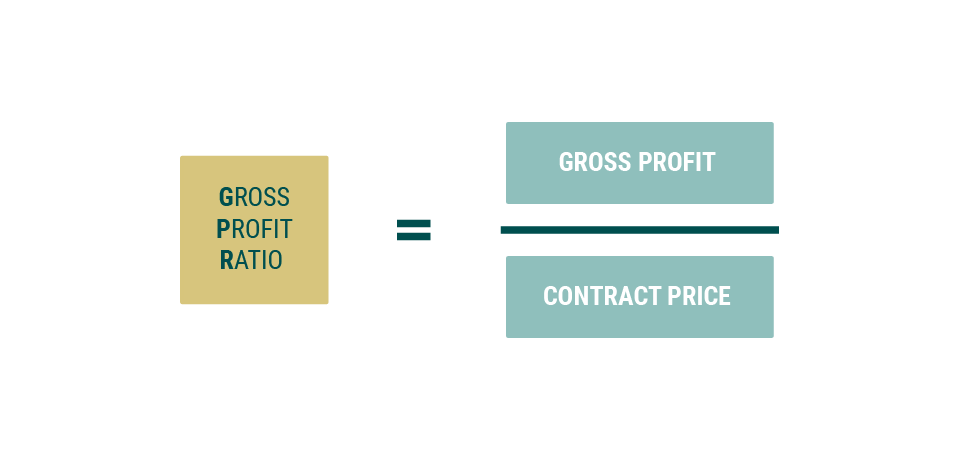

2 the transfer of. By using Section 453 of the Internal Revenue Code which pertains to. Instead of receiving the sale proceeds at.

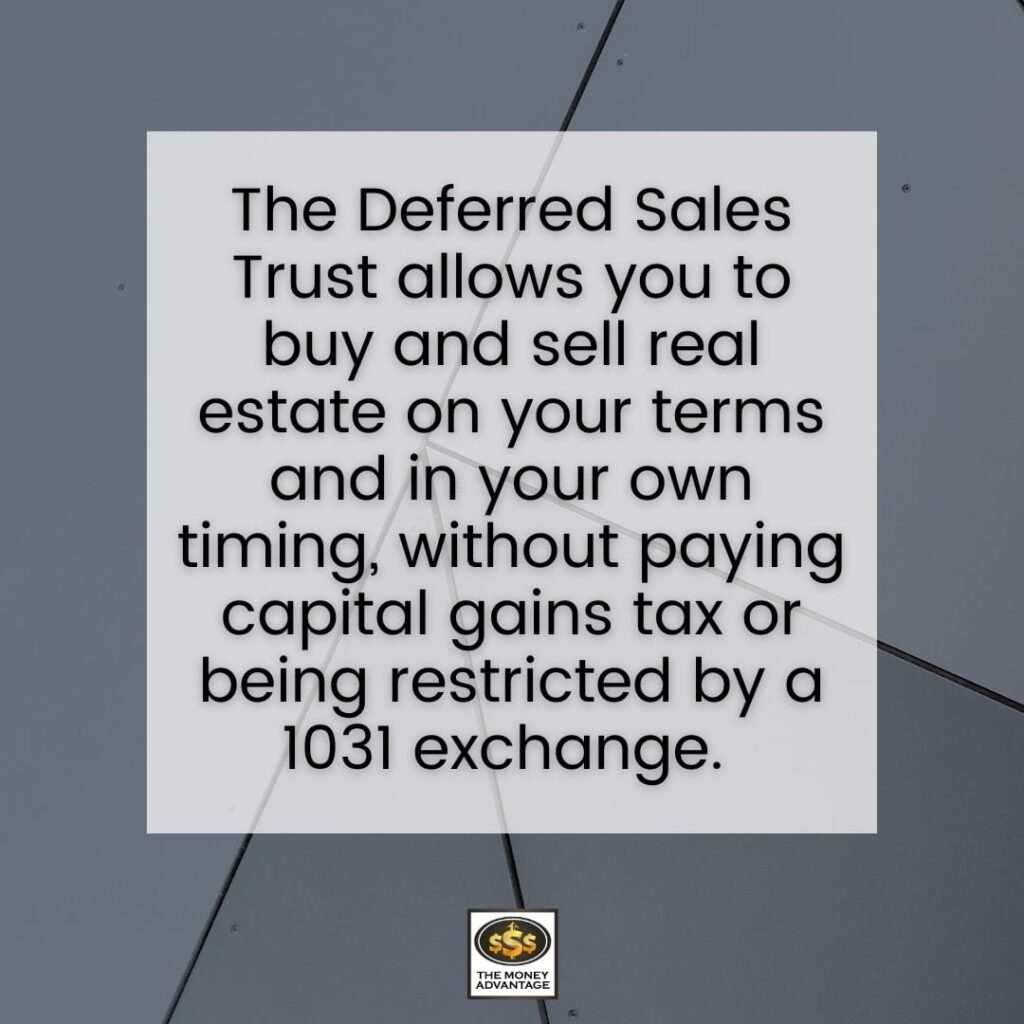

A deferred sales trust is a method used to defer capital gains tax when selling real estate or other business assets that are subject to capital gains tax. His company helps people escape feeling trapped by Capital Gains Tax with his deferred sales trust. His experience includes numerous.

Brett is the founder of Capital Gains Tax Solutions. The first and major disadvantage is that the Internal Revenue Service has not issued any guidance or rulings related to the Deferred Sales Trust at this point in time. Other Potential Issues with Deferred Sales Trusts Potential for mismanagement.

1 the use of an independent trustee. The problem is some people just dont want to go back into real estate. Pros and Cons of the Deferred Sales Trust.

Thats where the Deferred Sales Trust comes in. The DST structure raises certain issues that must be addressed by experienced attorneys and accountants such as. GET YOUR FREE GUIDE AND STRATEGIC CONSULTATION CALLClick this link now.

There is little regulation over deferred sales trusts. The problems with a Deferred Sales Trust Many people that are a part of the legal and 1031 exchange community do not believe this structure is legitimate for the purposes of deferring. Reef Point LLC October 28 2021.

Investing In Real Estate With Clayton Morris Investing For Beginners Deferred Sales Trusts Vs 1031 Exchange With Brett Swarts Episode 526

![]()

Capital Gains Tax Solutions Deferred Sales Trust

Small Differences In Mutual Fund Fees Can Cut Billions From Americans Retirement Savings The Pew Charitable Trusts

Deferred Sales Trust Www Touchpointbusinessedge Com

Could An Intermediated Installment Sale Reduce Your Taxes 1 On 1 Financial

The Tale Of Two Dst S Delaware Statutory Trust Vs Deferred Sales Trust Reef Point Llc

Solving Capital Gains Tax With The Deferred Sales Trust Brett Swarts

Deferred Sales Trust Problems Why Not Use A Deferred Sales Trust Youtube

Capital Gains Tax Solutions Deferred Sales Trust

Deferred Sales Trust Defer Capital Gains Tax

![]()

Next Steps Capital Gains Tax Solutions

Deferred Sales Trust Problems Why Not Use A Deferred Sales Trust Youtube

Pros And Cons Of The Deferred Sales Trust Reef Point Llc

Deferred Sales Trust 101 A Complete Guide 1031gateway

California Tax Board Disallows Deferred Sales Trusts Monetized Installment Sales

Estate Planning Team Dst Deferred Sales Trust

How To Eliminating Capital Gains Tax Using A Spendthrift Trust

The Importance Of Changing Your Bank Account Title To The Name Of Your Trust Ameriestate